pay utah state property taxes online

A June 30 2022 screenshot of the Cuyahoga County Treasurys new website shows several buttons residents can use to either pay their 2021 property tax bill online or look. You may pay your tax online with your credit card or with an electronic check ACH debit.

Online Relationship Ends In Divorce Divorce Lawyers Divorce Law Cottonwood Heights

109 21 Apr 2022.

. Call 801-957-7700 for assistance 8am to 5pm M-F Mountain Time excluding. Weber County property taxes must be brought in to our office by 5 pm. Online payments may include a.

You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. Most taxes can be paid electronically. The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property.

Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. Property Tax payments may be sent via the US Postal Service to the Treasurers Office. 1 of the payment amount with a minimum fee of 100.

Steps to Pay Your Property Tax. Skip to Main Content. 0 Electronic check payment.

Online REAL Estate Property Tax Payment System. Payments can be made online by e-check ACH debit at taputahgov. State Taxes Utah Property Taxes Utah State Tax Commission 2022 Sales Taxes State And Local Sales Tax.

Be Postmarked on or before November 30 2022 by the. They conduct audits of personal. This web site allows you to pay your Utah County real and business personal property taxes online using credit cards debit cards or electronic checks.

Pay online or by phone with a credit card through Instant Payments or call 1-800-764-0844There is a 25 or a minimum of 250 fee charged by Instant Payments depending on. This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks. Pay directly to the Utah County Treasurer located at 100 E Center Street Suite 1200 main floor.

Please contact us at 801-297-2200 or taxmasterutahgov for more information. Where Do I Pay Property Taxes Utah. Please contact us at 801-297-2200 or.

On November 30 or 2. PAY REAL AND PERSONAL PROPERTY TAXES. To pay directly to the Utah County Treasurer you must complete the online application available at the countys online office at.

Utahgov Renewal Express Utah State Tax Commission. For your protection do not send cash through the mail. State of Utah Office of State Debt Collection EZ Pay.

For security reasons TAP and other e-services are not available in most countries outside the United States. Payments must be postmarked by. These are the payment deadlines.

Utahs Official Vehicle Renewal Site. See also Payment Agreement Request. How Do I Pay My Property Taxes In Utah.

It does not contain all tax laws or rules. Sorry this page is under maintenance and will be. Change Your Mailing Address.

Pay utah state property taxes online Monday March 14 2022 Edit. TAP includes many free services such as tax filing and payment and the ability to manage your account online. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

You may also pay with an electronic funds transfer by ACH credit. Cars trucks SUVs motorcycles off-road vehicles trailers snowmobiles and watercraft are eligible.

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Property Taxes By State Report Propertyshark

Sales Tax Definition What Is A Sales Tax Tax Edu

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Where S My State Refund Track Your Refund In Every State

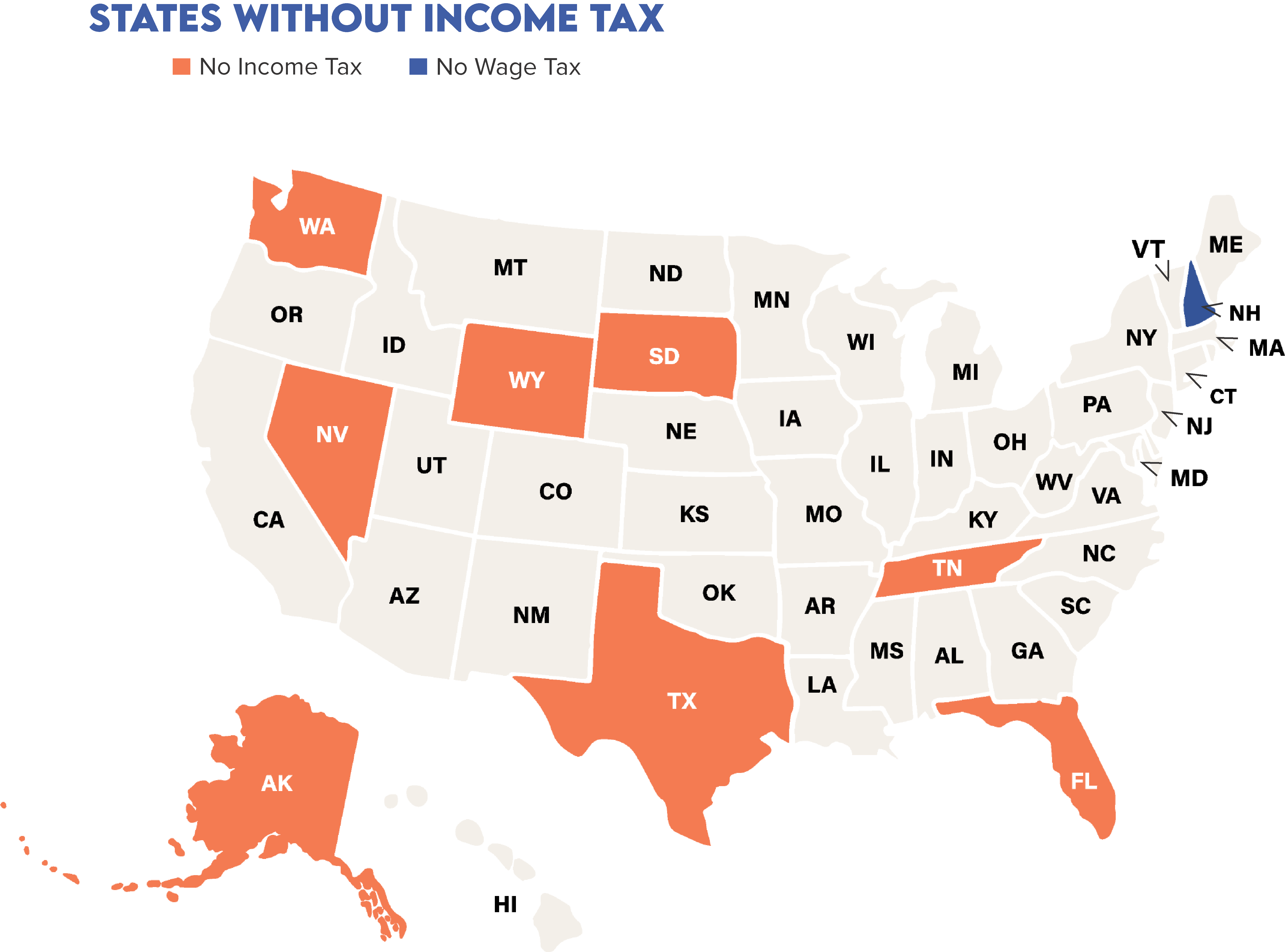

The Flight To Tax Free States Investor Tax Advantages

Fillable Form Personal Property Bill Of Sale Personal Property Person Bills

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Utah Property Taxes Utah State Tax Commission

Center For State Tax Policy Tax Foundation

States With Highest And Lowest Sales Tax Rates

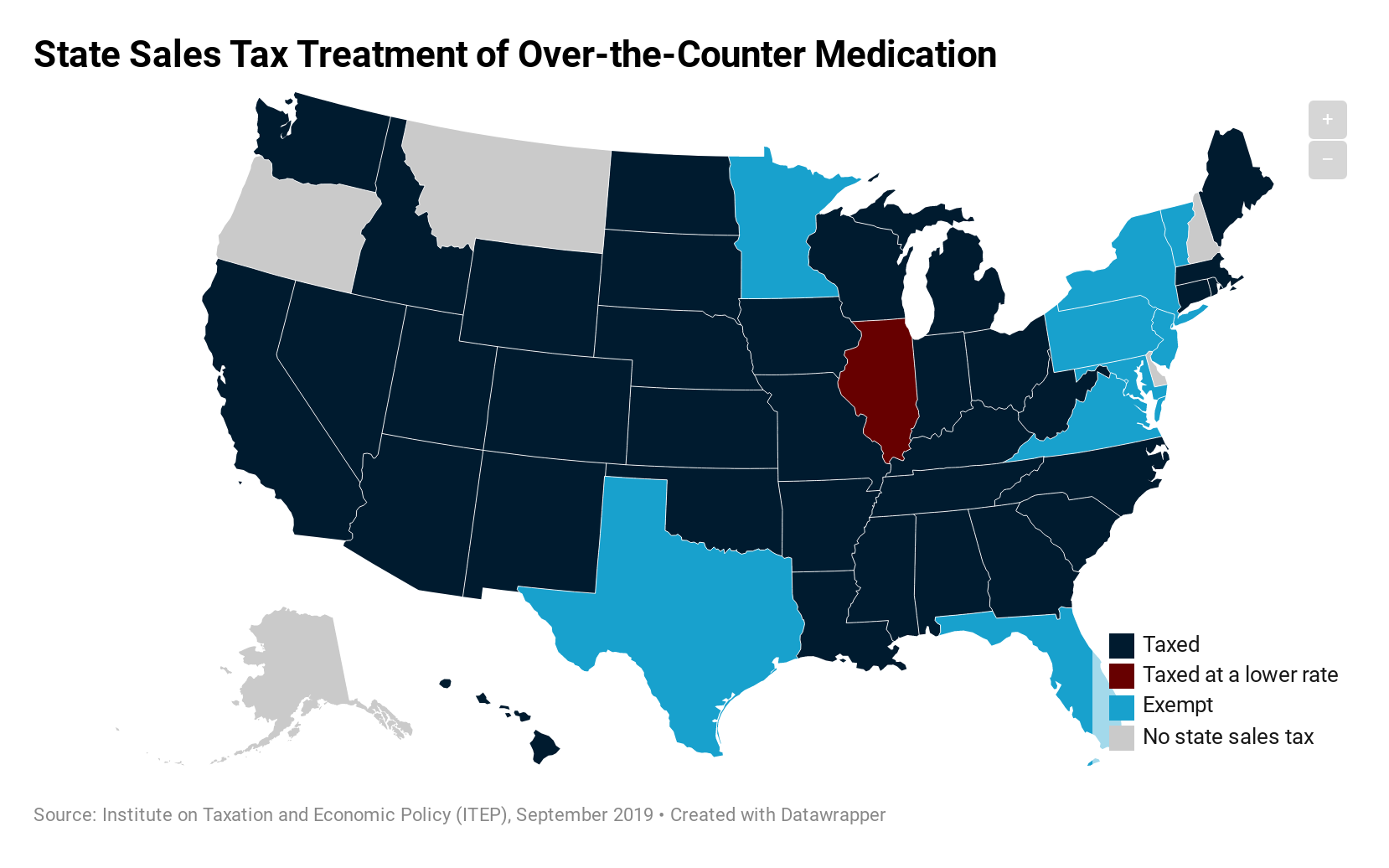

How Do State Tax Sales Of Over The Counter Medication Itep

State Taxation As It Applies To 1031 Exchanges

State Taxation As It Applies To 1031 Exchanges

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)